Prevent invoice errors

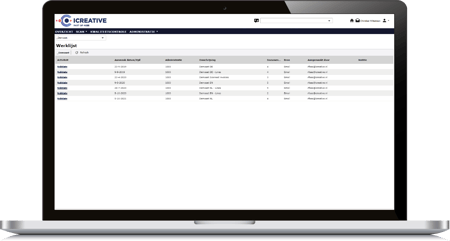

Automatic invoice processing is interrupted if key invoice information is incomplete or incorrect. Whenever, for instance, a VAT number is missing or incorrect, someone has to intervene and correct the missing part or error. To prevent manual intervention, invoice information can be validated automatically prior to being further processed.

Validation can be based by comparing invoice information with data present in an ERP or order system. Complementary, information can be compared, or even enriched, with data from external sources, such as the Chamber of Commerce or the VAT database of the European Commission.

Validation of XML invoices

Invoices are only validated automatically provided the information is available in a standardised data format (XML). Any invoice that deviates from the chosen standard, first has to be converted to e-invoices. By converting to e-invoices and validating the invoice data, the quality of invoice data and efficiency of invoice processing are greatly increased.

Time to connect?

Would you like to exchange thoughts on invoice validation. Please contact us.

For all other questions or remarks, please contact us via this link. For support issues, please contact our service center.