2 min read

Allow more faults to save costs

Vincent Wouters, Managing Director ICreative

Mar 7, 2017 11:18:22 AM

At the start of each purchase to pay implementation, the project group defines under what conditions an invoice will match with an order. These conditions are defined with common sense and are based on years of experiences. Sometimes it’s even a policy within the company that differences can’t be larger than amount X. given this fact our consultants will translate this common sense to the Alusta environment and every time an invoice doesn’t meet the criteria it will be transferred to manually matching.

But what does this mean?

It means that an invoice needs to be taken apart and researched by the AP clerk. In most cases this price difference can’t be tracked by the clerk and he/she will send it out to the person that made the order, the buyer. The buyer will look at the invoice and see that there is some logic behind the price difference, that prices aren’t updated in the purchasing system or other various reasons why the difference is correct. After this the invoice will be approved by one or multiple people and be released for payment. If a price difference isn’t trackable the buyer will contact the supplier and ask for an credit invoice.

So what can we learn from the previous scenario?

We have the habit to leave principals and rules in place if they worked for us in the past. But what if we could use the data from these scenario’s and use it to audit if these rules are defined correct?

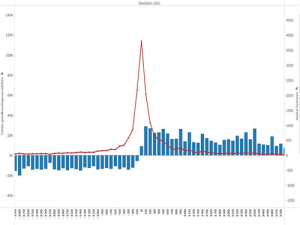

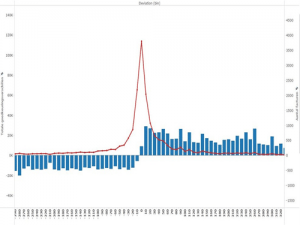

Example case at customer: Company X has the rule that an invoice can’t diverge more than +/- €10 and 1% from the total invoice. Alusta is implemented and 6 months later we extract all the invoice data and price differences. We use the data from Alusta to plot the graph shown below.

This graph gives us an insight on the following:

- Deviation of the invoices

- The number of invoices in a deviation bracket

- The total amount € in an deviation bracket

Researching the data shows that in 97% of invoices with a deviation between 0 <= x <40 is approved without any communication to the supplier or credit invoice being requested on the order. The picture below shows the data of invoices in the first brackets.

So what would happen if we would change the tolerances?

If the rules for tolerances where increased from €10 to 40€ 100% of the total amount would be payed unfairly to supplier where normally 97% of this amount gets payed. So this 3% of the total amount could be quite a number right? It is, but company X now has almost 7000 documents less (!) that needs to be reviewed. If both the AP clerk and Buyer spend an average minimum of 15 minutes on 1 document this would result in 1750 hours of labor. This could be a very large cost reduction compared to the 3% payed unfairly to suppliers.

Vincent Wouters

Managing Director, ICreative

vwouters@icreative.nl

06 22 455 138

About ICreative

ICreative delivers purchase to pay and e-invoicing solutions. As one of the main Basware partners in the world, we automate procurement and invoice processing for large companies, multinationals, educational and governmental institutions. Regardless of the ERP systems in use, including SAP and Oracle, and regardless of the number of offices, countries, currencies and languages in scope.